Strengthening Clients' Portfolios With A Fee-Based Annuity

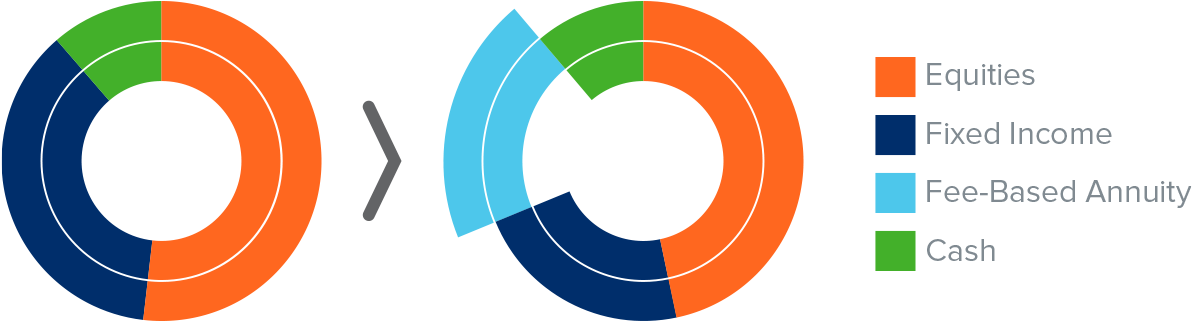

A traditional investment portfolio typically consists of 40 percent fixed income investments, such as bonds and CDs, and 60 percent equities. However, your clients’ retirement goals may require a more diverse approach, and allocating a portion of their portfolio to a fee-based annuity can help strengthen their investment strategy.

There are several types of fee-based annuities

with varying levels of growth potential and downside protection. As with most investments, with greater risk comes greater reward.

- A fee-based fixed annuity offers guaranteed growth and complete downside protection. This solution will grow in value at a fixed rate – which

is guaranteed for the initial term – and offers moderate earning potential.

- A fee-based fixed-indexed annuity offers market-linked growth potential and complete downside protection. This solution offers greater earning potential than a fixed annuity.

- A registered index-linked fee-based annuity provides market-linked growth potential and partial downside protection. This solution offers the greatest earning potential of all fee-based annuities.

Fixed-indexed and registered index-linked fee-based annuities offer growth opportunity linked to the following indexes and ETFs:

- S&P 500® Index

- S&P 500 Risk Control 10% Index

- S&P U.S. Retiree Spending Index

- iShares U.S. Real Estate ETF

- iShares MSCI EAFE ETF

- SPDR Gold Shares ETF

- First Trust Barclays Edge Index

- Russell 2000 Index

Available Index- and ETF-linked strategies vary by product. Russell 2000 indexed strategies only available on Index Achiever Advisory.

While our fee-based annuities are designed to bring long-term value to a portfolio, liquidity options are available.

Annual withdrawals

Most annuities allow a certain percentage, typically 10%, to be withdrawn each year penalty-free. This feature may be useful for portfolio rebalancing. For more information on product-specific withdrawal allowances, refer to the fee-based annuities product reference guide.

Included riders

Extended care and terminal illness waiver riders allow clients to withdraw their money without incurring early withdrawal charges or negative MVAs when certain criteria are met. There is no charge

for these riders.

Return of premium

With an Index Protector 7 fee-based fixed-indexed annuity, clients can surrender their contract after the third contract year and receive no less than their initial purchase payment

(minus prior withdrawals and applicable taxes and rider charges).

Check out our suite of fee-based annuities .