As you meet with new clients and review existing clients’ portfolios, you probably discuss their goals, risk tolerance and financial habits. But, there’s one question that might be missing from the conversation. The answer may provide an opportunity for you and your clients: Do you currently own an annuity?

If your clients own an old variable annuity contract, they may be looking for an annuity rescue. Non-qualified annuity contracts can be exchanged for another annuity contract without tax consequences through a 1035 exchange. A 1035 exchange may be appropriate for clients who want to move assets from old variable annuity contracts that no longer meet their financial needs or objectives. A fee-based fixed-indexed annuity may help your clients achieve their goals with these benefits:

If your clients own an old variable annuity, transitioning to a fee-based fixed-indexed annuity could decrease their risk exposure. Fixed-indexed annuities won't lose value, regardless of index performance, unless your clients withdraw money or surrender their annuity during the early withdrawal period.

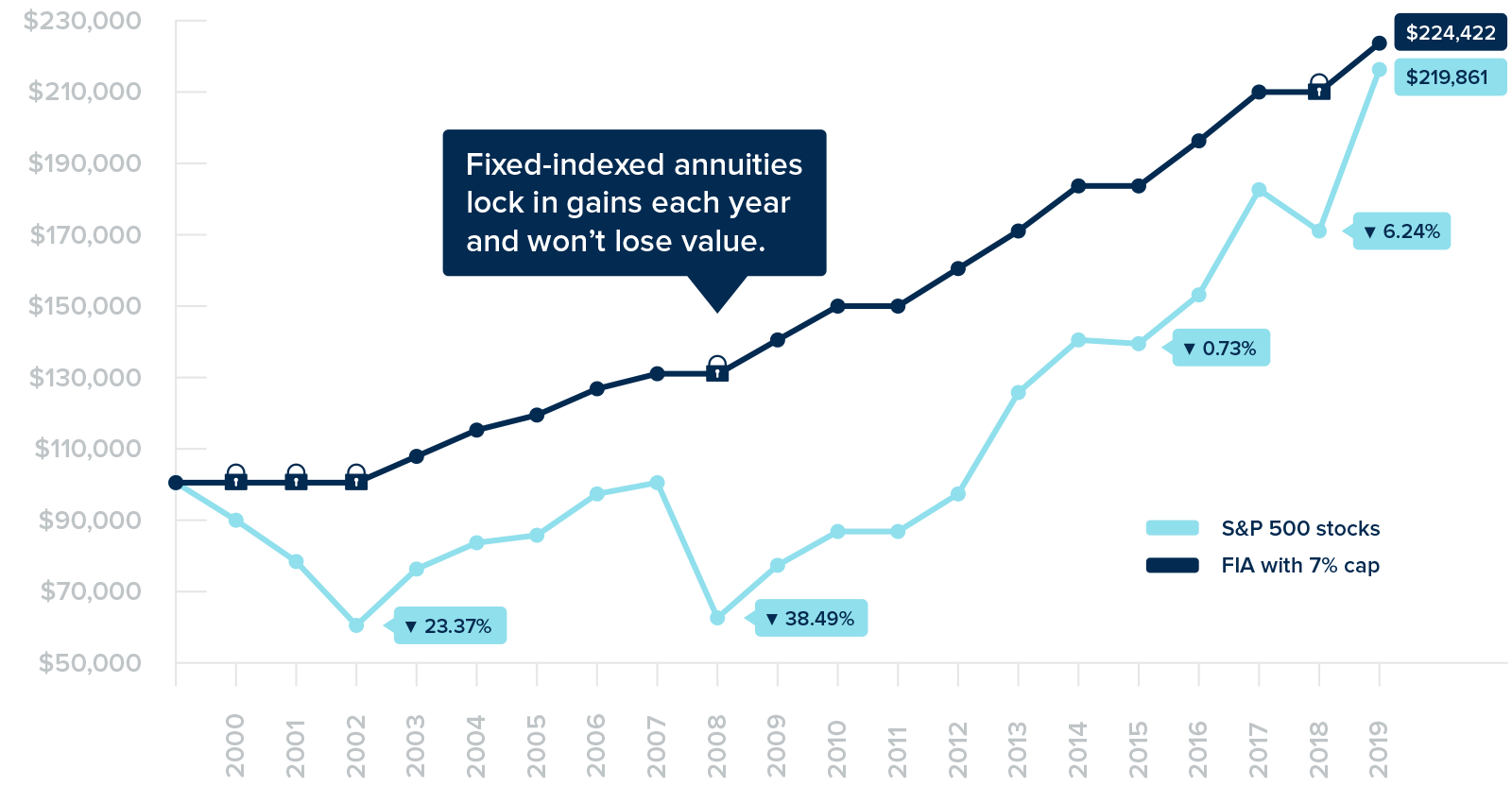

During past positive market runs, many Americans nearing retirement acquired a nest egg for later in life. Then, as quickly as that nest egg came, it went. With a fixed-indexed annuity, any interest credited to the account value is locked in at the end of each one-year term and cannot be lost due to future market performance.

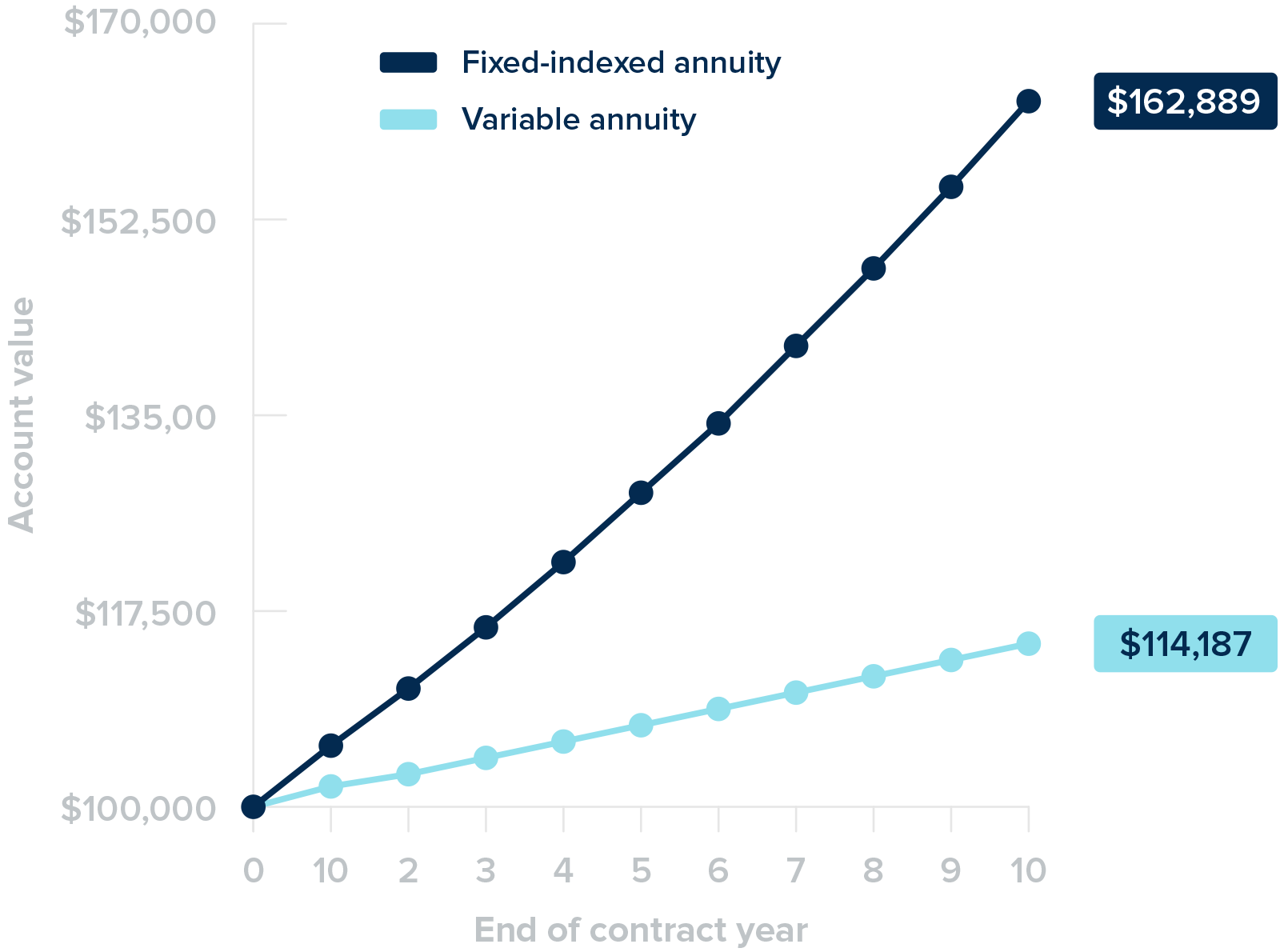

Many variable annuities charge annual fees, which can drag down investment performance. In fact, after factoring in mortality & expense charges, average subaccount fees and rider charges, your clients could be paying well over 3% in annual fees. By transitioning to a fee-based annuity , your clients may save on fees alone.

The chart compares the performance of a fixed-indexed annuity with no annual fees to a variable annuity with annual fees of 3.49%. For each annuity, it assumes a $100,000 purchase payment that grows by 5% each year for 10 years. You can see how annual fees can have a significant impact on the account value.

If your clients currently own a commission-based variable annuity, you might not be involved in its management and maintenance. Transitioning to a fee-based annuity allows you to consolidate these “held away” assets into the portfolio you manage. This creates a more holistic approach to planning, which can lead to a better experience for your clients.

Ask clients if they currently own an annuity.

Discuss the benefits of a fee-based annuity.

Contact our team for current product offerings and information about 1035 exchanges.

Help your clients make a suitable decision.

The “Protect Earnings With Locked In Gains” graph is not intended to show past or future performance of an indexed strategy. Graph illustrates historical performance of S&P 500 since 2000, excluding dividends paid on the stocks included in the index. Hypothetical fixed-indexed annuity assumes a $100,000 purchase payment, allocated to an S&P 500 1-year point-to-point index strategy with a 7% cap for each calendar year in the 18-year period shown in the graph. However, during the period shown in the example, the actual caps that we applied to our fixed-indexed annuities varied by product and from term to term and ranged from 2% to 10%. In addition, the one-year terms for our fixed-indexed annuities are not based on a calendar year but start on the 6th and 20th of each month. A different cap and a different term start date would affect the performance of the hypothetical FIA and result in higher or lower account values than those shown above. For example, if we assumed a 2% cap, then the account value at the end of 2019 would have been $129,355. This example assumes no money is withdrawn from the FIA. If clients take a withdrawal or surrender an FIA during the early withdrawal charge period, an early withdrawal charge and a market value adjustment may apply. An early withdrawal charge will reduce the account value. A market value adjustment may increase or reduce the account value.

The “Accumulate More By Saving On Fees” example is based on the annual fees of two competitive variable annuities as set out in their prospectuses dated May 1, 2019. The annual fees of each variable annuity include the mortality and expense charge, the average expense ratio of all subaccounts available under the annuity and the charge for an optional guaranteed income rider. A different annual fee would affect the account values and related savings on fees.

Clients should compare their current variable annuity and the new fixed-indexed annuity carefully and consider the benefits and risks of each annuity as well as any early withdrawal charges under the new fixed-indexed annuity. Clients should also talk to their tax advisor to make sure that their exchange will be tax-free.

The S&P 500 Index is a product of S&P Dow Jones Indices (“SPDJI”), and has been licensed for use by Great American Life Insurance Company. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Great American Life. Great American Life's products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates, and none of such parties makes any representation regarding the advisability of investing in such products nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index. Products issued by Great American Life Insurance Company, a wholly owned subsidiary of MassMutual. © 2021 Great American Life Insurance Company. All rights reserved.

For producer use only. Not for use in sales solicitation.