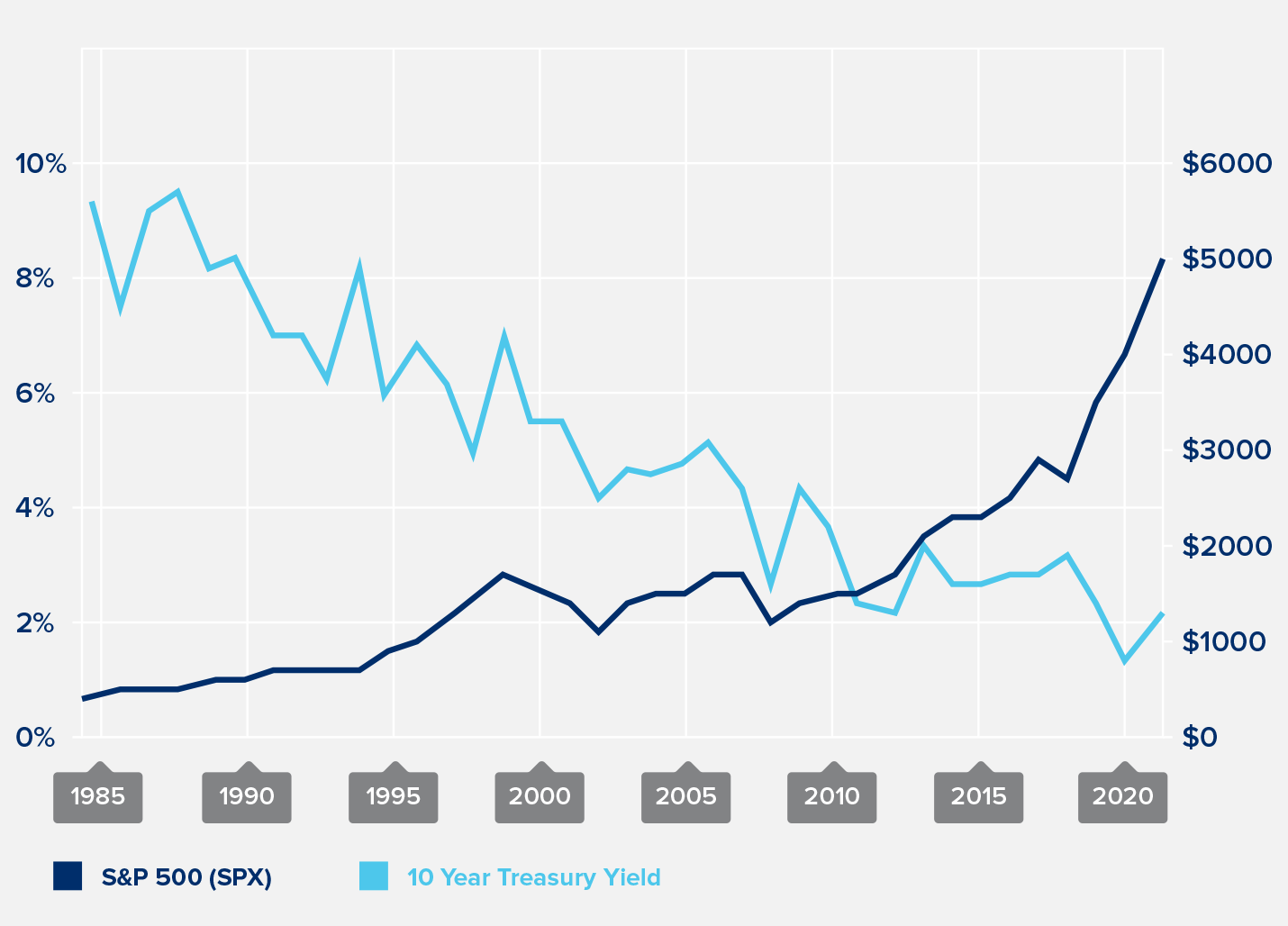

Fixed income investments are commonly used to bring safety and stability to a portfolio. However, interest rates and yields have trended down over the last 30 years, with the 10-year Treasury hitting an all-time low in early 2020.

On the other hand, equity investments offer growth potential, but may be too volatile for individuals with a shorter investment horizon, like those in or near retirement.

Given current market insights, you may be looking for an alternative solution to help clients accumulate more assets without taking on more risk.

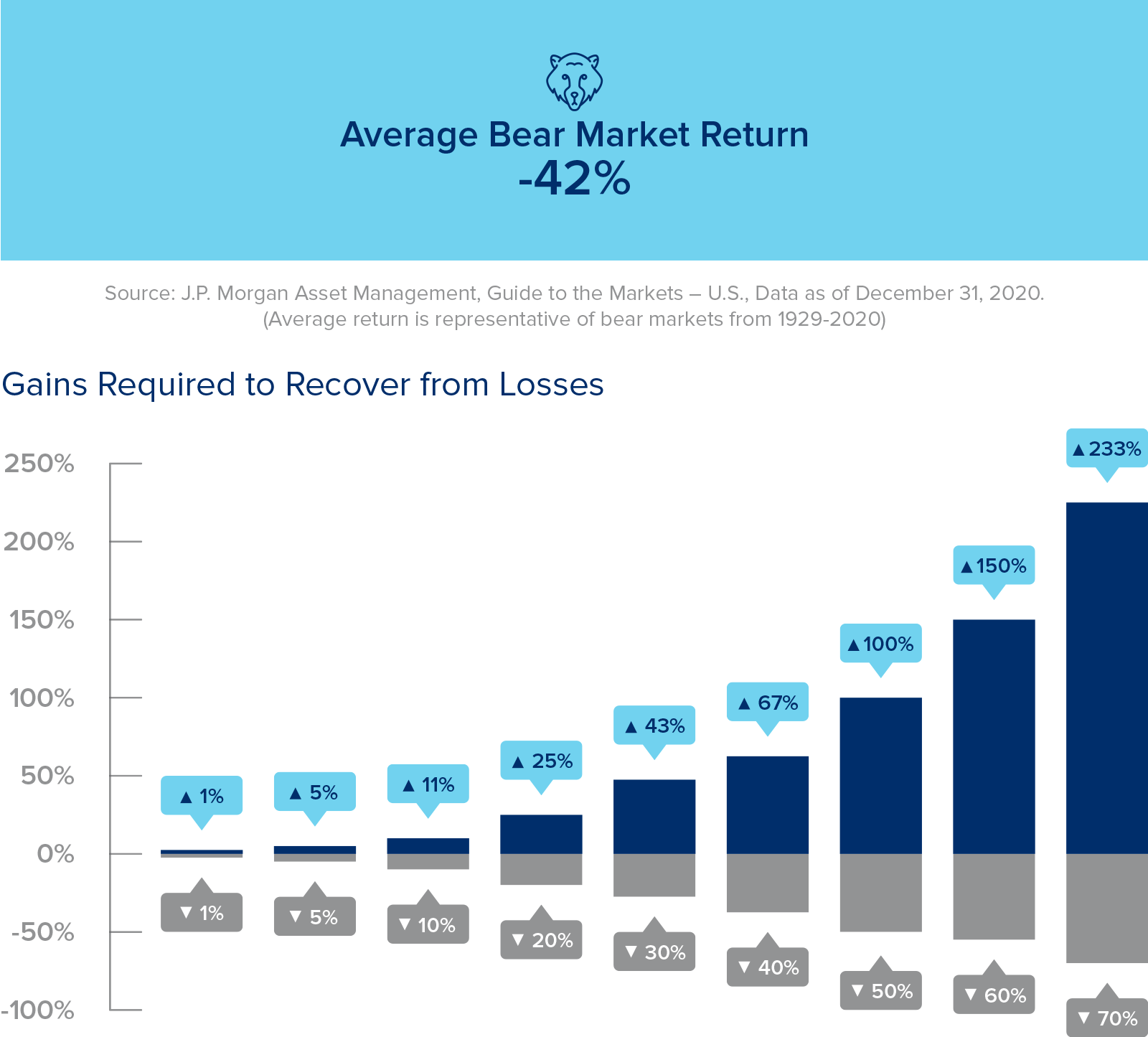

Consider those who invested in the S&P 500 in 2000. It would have taken nearly a decade to make up for market losses.

As history has shown, when long-run bull markets end, the decline may be pretty dramatic.

For that reason, your clients may not be interested in riding the waves of the market. Now may be the time to talk about moving some gains into a lower-risk option.

When you consider the average retirement now lasts 18 years, developing a reliable lifetime income strategy is an important step that shouldn’t be overlooked.

Fixed income investments are a common source of retirement income. However, these investments carry a level of interest rate risk. This means if interest rates rise, the value of a fixed income portfolio could decrease and generate less retirement income. Is it time to consider a new source of reliable lifetime income?

If interest rates rise 2%, the price of a bond with a 3-year duration would fall by approximately 6%. How would this affect your clients’ retirement income?